A new type of insurance fraud related to neural networks has begun to gain momentum in Russia. Attackers are forging photographs of damaged cars and trying to receive payments under Compulsory Motor Third-Party Liability Insurance. So far, there are few such cases, but experts warn: the technology is developing faster than protection systems.

Everything Went Digital

The reason for the emergence of the scheme is the mass transition of insurance companies to remote loss settlement. Clients were allowed to independently photograph car damage and upload images through applications. This sped up payments, but at the same time opened a loophole for abuse.

Photography and video are no longer unconditional proof. Now they can be "drawn".

"Crash" a Car for a Couple of Hundred Rubles

Announcements are already appearing on the network offering to "enhance the damage" to the car for a nominal fee. The scheme works like this: after a minor accident with a Europrotocol drawn up, the owner transfers a photo of the car to "specialists." The neural network turns a scratch into a deep dent, adds cracks, chips and damage to the lights.

As a result, damage of 10-15 thousand rubles on paper turns into 100-400 thousand. Formally, this is a criminal offense, but there are those who want to take the risk.

How Neural Networks Fake Reality

Modern AIs, including the latest generation models, can work not with abstract pictures, but with real photographs. A text command is enough - and the algorithm adds damage so that it is difficult to distinguish it from the real one.

You can show "the same" crack from different angles, zoom in on it, change the lighting. For the human eye, such images look convincing.

Why It's Getting Harder for Insurers

An expert is theoretically able to recognize a fake by details, but in practice it is difficult. One loss adjustment specialist handles dozens, and sometimes hundreds of cases. In conditions of high workload, no one will carefully study every pixel.

So far, insurance companies are coping with selective checks and analytics, but the question remains open: what will happen when fakes become indistinguishable from reality.

What This Threatens the Market With

The growth of such schemes may lead to stricter checks, slower payments and an increase in the cost of Compulsory Motor Third-Party Liability Insurance for everyone. The digital convenience for which procedures were simplified risks turning into a new round of distrust.

Read More Materials on the Topic:

Now on home

Expert says that 10-12 brands from China should remain in the Russian car market instead of 56

Why current engines last less than before and whether they really cannot be repaired - debunking myths

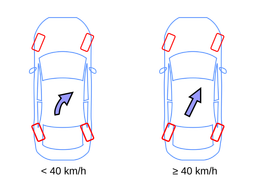

Why the four-wheel steering system disappeared in the 2000s and returned on heavy premium models

The novelty is being tested on the roads of the capital

69% of young buyers are open to new brands, but dealers express doubts

Who raised car prices, and which models became cheaper

A survey by the Avtostat agency revealed the best mileage to sell a car

Avtodor publishes new prices for travel on M-4, M-11, M-12, Central Ring Road and M-1 and a list of sections without indexation

Autostat Publishes Ranking of Most Interesting New Products in the 2026 Auto Market

Formula V6, Wankel rotary engine, gas turbine, and even two engines at once - recalling the most unconventional solutions

Handling, acceleration, reliability, and emotions - what actually changes depending on the type of driving wheels

The plant in Leipzig will start using humanoid robots in the battery assembly shop